In this video, OMB Solicitors Special Counsel, Jennie-Rae Goff, discusses the things you need to know about work injuries.

In this video, OMB Solicitors Special Counsel, Jennie-Rae Goff, discusses the things you need to know about work injuries.

In this video, Rebecca Purcell, a Solicitor at OMB’s Litigation team, talks about neighborhood tree disputes and how OMB Solicitors can help you with your litigation matters.

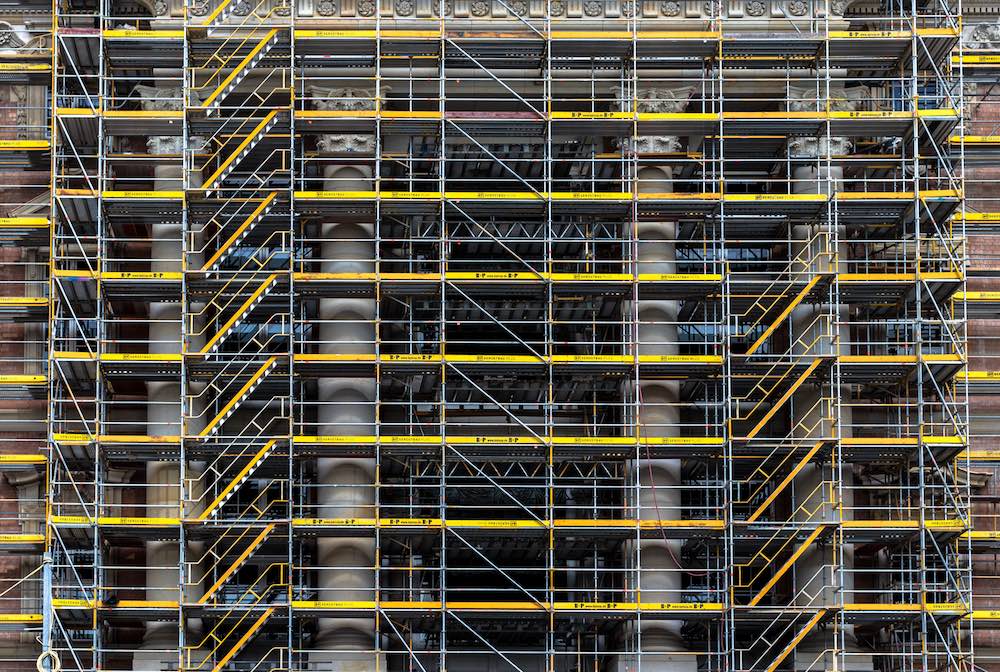

In this video, OMB Solicitors’ Partner, Cameron Marshall, talks about what you need to do and how Gold Cost Lawyers can help when you as an owner of land have a development happening next door and you get a request for access to your property.

Transcript

Good morning, my name’s Cameron Marshall, I’m a partner at OMB Solicitors. Today I’m going to talk about what happens when you, as an owner of land, have a development happening next door and you get a request for access to your property.

It’s a very common occurrence on the Gold Coast, development is what built this city and it will continue to do it in the future. That said, it when someone comes and asks you for access to your land, what do you do? Well, there’s a few things you can do, and I’m going to go through those today with you.

So the first thing is don’t panic, okay? It’s a very common occurrence of a developer wanting access, especially for swing plans for cranes over a neighbour’s land, okay. So first thing, don’t panic, it’s common. We at OMB can help you out and deal with it.

That brings me to step two. What do you do? You come and see OMB Solicitors and we will help negotiate what they call a access deed if you wish to give access to your property and that brings me to a little bit of the law on this situation is, firstly, you own your land, you don’t have to give access to the developer next door if you don’t want to.

I’ll raise one caveat with that, there is legislation, the Property Law Act, which does provide that a landowner is able to seek access through the access of the legislation, if it is essential for the use of their property to have to be able to access your land, okay.

So there is a provision in the law that allows access to be sought through the courts, but that’s granted only after a certain process is satisfied and criteria are ticked off. So I’m not going to go through that today, but I just wanted to step one is you don’t have to give access. But there are some caveats to that statement.

The next part I wanted to discuss is why would you give access to a property owner wanting access to your land? Well, there’s a few reasons. The first one, and it’s an important one, is it gets you a seat at the table, so to speak, of the development next door. So a tenant of law that goes back for hundreds of years is a landowner can do what they want with their property, okay.

So if someone’s wishing to build a development next door to your property, as long as it’s compliant with the appropriate approvals, they can do so. You have limited right of objection to what happens on their land because it is their land.

However, if they want access to your land, then you get a seat at the table to be able to have a say in things that you otherwise may not get a say in. I’ll give you an example, work hours. The development approval will have a work hours from the council.

You may decide if you, say, operate a business or if you’re a body corporate, that you may wish for a little bit quieter period from a 6:30 start that’s allowed and want to push it out to say, 7:30.

You could negotiate with the landowner next door to be able to be a part of the access provisions that those hours of work are changed, otherwise you wouldn’t get it. Another thing you normally would be able to negotiate is an indemnity.

If something happens and damages your property, you get a right of indemnity, usually under the deed of access as a condition of you providing access to the property.

That means if something happens to your land or your property, you’ve got an easier right of compensation and a right of recovery against the developer next door.

Another reason is compensation, compensation can be sought and asked for and is commonly given when a developer is wanting access to a property. Of course it can’t be unreasonable, but it allows some type of compensation for you giving up the right of the use of your land for a period of time.

There’s also insurances cover, you can make sure that are taken so the developer has the appropriate cover in the case that something goes wrong, hopefully it won’t, but if it does, you want to ensure that they’ve got appropriate cover.

There’s other things that can go into the deed, but generally it is a way of ensuring protection for your property as a trade off for the use of your land for a period of time.

It’s not an indefinite period of time, of course it’s up to you how long it extends, but it’s usually for the extent of the development. So if a landowner next door is wanting access to your property, don’t panic, come and see OMB solicitors and we can walk you through the process without stress.

Thank you.

In this video, Samuel Layani, Solicitor at OMB Solicitors, talks about the process of planning an environmental court appeal.

In this video, OMB Solicitors’ Partner, Cameron Marshall, talks about bodies corporate and litigation.

In this video, OMB Solicitor Samuel Layani talks about a few matters about debt recovery in a post-COVID climate.

In this video, OMB Solicitors Partner Cameron Marshall discusses building contracts and why getting legal advice is crucial to avoid conflicts in your contract.

In this video, OMB Solicitors Partner Cameron Marshall talks about how we can help you in your litigation matters from an early stage in the proceedings, particularly building a claim you may have because of defective work.

In this video, OMB Solicitors Partner, Cameron Marshall discusses how to resolve a building defect dispute effectively.

The disease’s disruption to our economy has been severe and is expected to be prolonged. The impact has already been obvious on the revenues of Australian businesses and the employment of workers. It is also the fact that many businesses and individuals who have loans from financial institutions, or receive goods from suppliers on credit, have been put in a position where they have – or will soon – default on their repayments and face bankruptcy.

This situation is, of course, stressful and challenging for lenders, faced with losing most of their assets, but also for creditors who need to make decisions about enforcing their rights to repayment, helping the lender via a repayment plan or debt agreement, or working out some other solution to recover the amount owing.

As a response to the COVID-19 pandemic, in March 2020 the Australian Financial Security Authority made changes to Australia’s Commonwealth bankruptcy laws to provide relief to those businesses and individuals experiencing financial difficulty.

These special measures were originally scheduled to end in late September but have now been extended to 31 December 2020.

In order to help those whose ability to meet loan repayments or payment for goods supplied on credit, for example, has been affected by COVID-19, the key debt relief measures announced in March and now extended comprise:

While major financial institutions are able to manage this extended period of debt relief for its lenders due to their size, smaller operators and business owners suppling goods on credit to consumers will be adversely affected. In many cases, they will not be able to pay their own bills and other liabilities as a result of the extension of debt relief for their consumers.

Accordingly, creditors will need to weigh up their options in initiating the enforcement process during this time.

Importantly, a Court Judgment is enforceable for up to six years (or twelve years with leave of the Court). In some instances, a court judgment can attract interest on the debt owed by the debtor at the post-judgment rate, with creditors able to take further steps such as a wage garnishee order to enforce repayment of the amount owing or seizure and sale of an asset. Accordingly, Bankruptcy may not be the only enforcement option available.

If a creditor decides to proceed to Bankruptcy then the customer/debtor can file for Temporary Debt Protection (TDP) with the Australia Financial Security Authority (AFSA), which stops the creditor from being able to take further enforcement action for a period of six months.

The TDP process requires the customer to file a brief statement of their financial affairs with information about income, assets and debts. This information is then supplied to the creditor in order to give them the full picture of the debtor’s position.

The creditor and debtor may then contact each other – with or without legal representation or intervention by the AFSA – during the six-month debt relief period to attempt to work out a debt repayment arrangement.

For those supplying goods on credit terms to customers, the AFSA suggests registration on the Personal Property Securities Register (PPSR). An agreement with the customer combined with valid registration on the PPSR can assist creditors in having their invoices paid or the goods returned in the event that the customer is unable to pay or files for bankruptcy.

Where a bankruptcy notice was issued before 25 March 2020, It remains the case that the debtor has 21 days to comply with the bankruptcy notice.

Additionally, for those in bankruptcy before the introduction of the Federal government’s Coronavirus Economic Response Package, any support payments are not claimable by the bankruptcy trustee as income or as an asset, regardless of whether you receive the payments before or after the date of bankruptcy.

COVID-19 supplement payments are claimable by the trustee if received before the date of bankruptcy and still in the debtor’s bank account when they become bankrupt.

If you are a creditor with customers facing bankruptcy or require assistance enforcing a Judgment, we at OMB solicitors can help you.

Whether it’s understanding the detail of the COVID-19 debt and bankruptcy relief measures (now extended until the end of 2020), helping you formulate a legally binding debt agreement with a debtor, or initiating court proceedings to enforce a debt, we will help you find a way to recover the debts owing to you so that you return to a strong financial position once the pandemic is over. Call our OMB Gold Coast Solicitors today on (07) 5555 0000 or email us at [email protected] for an initial consultation.

In this video, OMB Solicitors Senior Associate, Cameron Marshall explains how COVID-19 affects debt recovery in Queensland.

While businesses in this situation certainly have legal rights that allow them to take action to collect from debtors, there are also many pre-emptive things a business can do to both reduce the prospect of indebted customers, and improve your internal processes for recovering debt. We’ve listed 10 essential points any business should consider when approaching the area of debt recovery.

Many of the problems with customers who struggle to pay stems from a lack of initial due diligence on the part of the business that extends them credit. By first checking publicly available company information and otherwise gathering as much information as possible about the business you’re lending to, you can effectively ‘screen’ those who are likely to be able to repay from those who are not… and hopefully reduce repayment problems.

A decision to offer a debtor a discount or some other incentive to pay you back early or on time obviously needs to be weighed against the costs of chasing them for payment. Many businesses will prefer to be paid back at a slight discount, maintaining cashflow, rather than spend time and effort chasing debts. If discounting payment is not an idea you wish to entertain, other incentives such as offering certain customers exclusive products or access can also encourage on-time payment

While it seems obvious, many businesses use contracts that are either too vague on key details, or alternatively too heavy with legalese for those to whom they extend credit to understand. The guidance of a legal representative with experience in debt recovery is often essential in helping a business draft a succinct, clear and transparent document which sets out payment terms, methods of payment, time limits, manageable credit limits and penalties for non-payment by those they extend credit to. This can avoid any ‘they said-he said’ disputes later, and prove crucial if legal action for debt recovery is later required.

By diversifying the methods by which customers can pay, you can encourage them to honour their obligations rather than ignore or delay them. A payment plan or instalments might be better than not getting payment at all, but obviously this decision will depend on the size of your business and your cashflow position.

Many businesses make the mistake of having more than one person responsible for chasing up late or non-paying customers. This can lead to confusion and duplication, particularly in larger businesses with many clients. Ideally there is one person, or a dedicated team leader, responsible for debt collection, streamlining the interaction of the business with debtors. In smaller businesses, if this seems too big a job for one person, external experts can be employed. Many law firms now offer specialist debt recovery services.

Following on from point 5, a debt recovery officer should be managing a systemised process of invoicing and follow up of late payments. Whichever way this is done, the process should be accessible to all those involved in transactions between the business and clients. The process should also be clear and transparent for the customer, so they are aware of what the follow-up contact is in relation to.

This point follows on from 5 and 6 but again, also applies to anyone in the business who deals with customers. In these days of email and online portals, it’s easier than ever for customers who owe money to ignore or put off requests for payment until it suits them to pay. Sometimes a good, old-fashioned chat on the phone between, say, the debt recovery officer and the client, can lead to quicker payment. There’s still no substitute for dealing with a real human.

While there may be a contract in place, and there have been polite requests for payment and even a friendly chat on the phone, you should also consider a written ‘payback’ commitment presented to the debtor when the debt becomes payable. Here the debtor acknowledges the debt, explains why it hasn’t been paid on time and promises to pay it back by a specific date in a return email or letter. This document, like a contract, will also assist if later legal action is required for non-payment.

A comprehensive and accurate record of all the ways the business has contacted the debtor should be kept. These days, various software tools make this easy to do. A record of the contact made with the debtor will be vital if legal action needs to be commenced against the debtor.

Obviously there comes a point where a business has tried everything to get a customer to pay, without success. At this stage the logical course of action for the business is to cut off service and/or credit to the client and consult a lawyer about the next steps to recover the debt/s.

OMB Solicitors has many years of experience in advising and guiding businesses on debt recovery actions. If any of the issues raised in this article provide you with questions or concerns, contact OMB Gold Coast Lawyers today on (07) 5555 0000 or [email protected].

In this video, Litigation and Dispute Resolution Senior Solicitor Cameron Marshall explains how we can help you with Protecting your Assets – Property Purchase Agreements.

In this video, Litigation and Dispute Resolution Senior Solicitor Cameron Marshall explains how we can help you with matters regarding Litigation and Dispute Resolution.

In this video, Dispute Resolution Senior Solicitor Cameron Marshall talks to us about issues for Bodies Corporate when entering into a contract.

Good morning. Cameron Marshall is my name, I work at OMB Solicitors as a Senior Associate in the Litigation Department. Today, I want to talk about five things from a body corporate’s perspective when entering into a contract for building work to be carried out at a body corporate’s building.

It’s very important when a body corporate is looking to engage a contractor in doing some work is to understand how a contract works. You should see a solicitor, of course, but some basic things that you need to make sure that are covered, I will go through now, they’re pretty simple.

The first one’s the parties, now, the main thing is you need to know who you are contracting with and in Queensland, whether they’re licensed to carry out the work. I’ve seen a lot of cases where builders have engaged in work in contracts, but they haven’t got the appropriate work to carry out such work.

This is very important when you’ve got multi-high rises because only an open builder can carry out such works and a lot of contractors out there may not have that qualifications. If you engage a contractor that doesn’t have the right licence, that could have problems with insurance, et cetera, down the track.

Next thing you need to understand when you’re looking at a contract is what work are you asking to get done? It needs to be set out in the contract clearly so that both you as the committee understand what work your builder is to carry out, and so he understands what is to be carried out, so it should be in fairly simple English, attached as a scope of works to the contract so the parties are aware of what’s going on.

The third thing is insurance, very important for an embodied corporate committee to ensure that insurance is in place. So you ensure that the builder has the appropriate insurances. Naturally, the body corporate will have its own insurance, but you need to make sure that the bill is also appropriately covered.

Now, you’ll need to make sure that they’ve got public liability insurance for both personal injury and property damage, work cover insurance to make sure all their workers are covered, and that should also extend to any subcontractors that they have and the final one is the works insurance.

Now, that affects if there’s any damage to the actual physical works getting carried out whilst the contract is in place.So that’s important that those things are in the contract, a lot of the time they’re not.

The next thing that needs to be covered is payment; when is the body corporate committee supposed to pay the builder? Is it upon demand? Is it upon a certification being provided by the project manager saying that all the work is being carried out in accordance with the contract? Either way, the body corporate committee needs to know when they’re supposed to pay.

So when it comes time to pay, they know that they’re not getting hoodwinked or short sold on work that hasn’t been completed, that will be very important when you report back to your body corporate members, no doubt at the conclusion of the work or if things go over budget.

So there five things that are quite easy to make sure that are in the contract when you’re entering into that stage. But importantly, you should always see a solicitor because they are very complicated documents and also the works can be quite expensive and will hopefully last a long time if they are done correctly and the body corporate is covered appropriately.

The last point that I want to go through is the issue of retention money. Retention monies are monies that are held back from the builder or the contractor to cover any building defects or problems that might arise after the work is being carried out.

Now, this can be done in a number of ways, it can be cash retention from each of the payments that are due to the builder. So the builder would give you an invoice and you would pay less than a certain amount of retention monies which are held back.

Another way is by way of bank guarantee. Either way, I would advise that the body corporate committee should ensure that there is some retention money scheme in the contract, a lot of the time there’s not.

It just provides that extra safety, if there are defects that need to be fixed, at least the body corporate has recourse to some amount of money from retention monies to fix those defects if the builder is not willing to.

Litigation can be inherently uncertain, time consuming and expensive. This is fundamentally why the majority of disputes that come across our desk are resolved out of court.

Parties are encouraged to participate in Alternative Dispute Resolution (“ADR“) in all jurisdictions in Australia. However, the type of ADR process used will differ depending on the nature and circumstances of the dispute. These processes can include Conciliation, Settlement Conferences, Arbitration or Mediation.

Whilst there are some matters that can only be resolved by determination at trial, if the parties can assess the value of what they are fighting for and weigh this up against the costs of going to trial, a resolution at Mediation will save on time, money, opportunity and emotion.

Mediation is a common process used for settling disputes with the assistant of an impartial third party, ‘the Mediator’. It allows the parties to flesh out the real issues in dispute and to encourage the parties to compromise on certain matters in order to achieve an outcome.

Parties can mutually agree to participate in Mediation or, otherwise, in some instances, are ordered to participate by the Court.

Mediation can occur at any stage of the proceedings but the earlier the better, before the costs start to escalate and your wallet starts to hurt.

The five major benefits of participating in a Mediation are:

At mediation both parties will have an opportunity to have a say and agree on an outcome that they would be prepared to walk away with.

The parties can also agree to specific terms and releases which mutually benefit one another.

Mediation is likely the last opportunity for the parties to resolve the dispute prior to a final hearing. Once a final order is made there will only be one satisfied party, the successful one.

A resolution at Mediation will result in a mutually beneficial outcome without necessarily one party being more out of pocket more than the other (depending on the terms of settlement).

Mediations are conducted on a without prejudice basis which allows the parties to discuss matters openly and without pressure of offers being used against them at a final hearing.

Further, unlike the potential publicity of court proceedings, everything said at the mediation is entirely confidential to the parties (unless specifically agreed otherwise).

Mediation allows the parties to vent all issues, including issues which may not be particularly relevant or pleaded in one’s claim.

It also provides an opportunity for apologies, statements of regret, acknowledgements and confidentiality clauses to be included in the settlement which is more than what a hearing could provide.

These benefits speak for themselves.

Gold Coast Lawyers at OMB Solicitors can assist you in resolving your dispute in a commercial and timely manner. We provide tailored advice to client’s based on the individual circumstances of the case.

If you wish to talk to a member of our litigation and dispute resolution team, please do not hesitate to contact us Family Law Mediation Gold Coast today for a free telephone consultation – Phone 07 5555 0000.

Conflict is sadly a part of most relationships, be it business or otherwise, but in the context of former, litigation for many is often their preferred choice to resolve issues. In this podcast, Heath Berghofer of OMB Solicitors provides useful information on the processes available to you in resolving disputes.

Podcast: Play in new window | Download

TRANSCRIPT

Dan: Heath, why do people choose to litigate?

Heath: People choose to litigate most normally to recover a debt or potentially to resolve some form of dispute. Normally it’s around a commercial law issue, but sometimes it can also be to right what they call a wrong that’s been made against them.

Dan: Do people choose other alternatives like mediation, or the other options available to them?

Heath: Yes, they do. One of the things we like to discuss with people when they first come in or they want to sue someone else to recover money or potentially some sort of family law matter to resolve a dispute between their former partner, the question is always, what are we trying to achieve here? How much it’s going to cost? It’s an important thing to keep in mind from the outset because obviously litigating can be a very expensive exercise and there can be, in some cases, no winners at the end.

Dan: There’s often a winner and a loser, isn’t there? Worst still, you’re giving that discretion to somebody else to make the decision for you, potentially?

Heath: That’s right. That’s very important. So particularly at the outset of any sort of dispute, for example a monetary dispute, someone’s done work for another person and that person has decided for one reason or another not to pay, the question needs to be asked at the outset, ” yes, you may have been wronged, and yes you may have an action, but how much is it going to cost you to recover this debt?”

The first question is, how much is the money that’s owed? What are my options for recovery? So that leads to two potential avenues. The individual could go through our Queensland Civil and Administrative Tribunal, which is a very fast and effective dispute resolution process, which involves things like mediation and gives those options for people to potentially resolve their own dispute, and if they can’t resolve it, go before a judicial member to have their dispute resolved.

Alternatively, they can pursue their debt recovery matter through the state courts, depending on what monetary amount they’re seeking to recover. But if that amount, for instance, is $5,000.00 or $10,000.00, it would be very difficult in certain circumstances to engage a solicitor to effectively recover that debt. So then it becomes a question of the individual; do I want to pursue this myself through our tribunals? Because it’s not only a monetary decision they need to make, but also a time commitment as well. There’s an emotional component that touches every piece of litigation. Litigation can go for a number of years, and it can be quite a tax on an individual emotionally to go through the process.

Dan: Heath, how do people actually prepare themselves for litigation?

Heath: That’s a good question. It’s very difficult for people to properly prepare for litigation, because you really don’t know what the outcome is going to be. But I think a clear mindset of what a person wants to achieve at the start is the most important point. A good question to ask is, what’s this going to cost me? What am I going to achieve here? Because ultimately, if you walk into any sort of debt dispute matter or litigation with the objective of punishing the other person, well more often than not you can end up effectively just punishing yourself through your own actions. That’s not what you want to achieve. You want to be able to achieve a result here that’s beneficial to you, not the opposite.

Dan: So if a person wishes to litigate, what are the steps? I’m assuming that they need to go and seek some legal advice before contemplating this?

Heath: The person firstly should get some legal advice. They should go to a solicitor. If they can’t afford a solicitor, then they should go to one of our free local community centres in the Gold Coast region. After receipt of that advice, they’ll need to make a decision about what they want to do with the dispute. That may be at the first instance to contact the other side to see if they can resolve between themselves, which is always a very good option.

If the other side doesn’t want to discuss the matter or resolve the matter, then they need to make a decision as to whether they want to institute any sort of formal proceedings, either in QCAT or our state courts, or walk away from the dispute from a commercial basis, conceding that it’s going to cost a lot of time, money, and effort to do this. Maybe it’s better for me to spend my time with my family and with my job, because that’s going to be more beneficial.

If they do take the course of instituting the proceedings, then they can go in a number of directions. QCAT, for instance, it means preparing the required documentation, filing the first step for a mediation between the parties, which can be very effective in most circumstances. It can get the parties meeting each other to discuss the issues and potentially resolve it. If that doesn’t resolve the dispute, then they’ll be before a tribunal member who will resolve it for them. I think the key there, and the key with all of this is if you get before that tribunal member, that may be a decision that both parties ultimately are not happy with. So it’s something to consider at the very outset that, again I refer to what I said before, there may be no winners because ultimately the decision may be in no one’s favour, and everyone will come out unhappy.

Dan: I was just going to say Heath, the irony or the paradox of all this is that for those people that perhaps are wanting to punish the other side, the path to resolution does always involve mediation, so they’re going to have face off with this person at some point during the journey, aren’t they?

Heath: That’s right. It’s a really important step, particularly face-to-face mediation, getting the person in the room opposite you is normally the best way to resolve a dispute with someone facing you. You have to speak your complaints or the issues that you have and what you’re trying to resolve here, rather than doing it through paper or over the telephone. It seems to produce a better result for whatever reason.

Dan: So, okay. It’s gone to litigation, or has gone to court. Now what are the outcomes of litigating? What can be the orders given by the judge or the tribunal or whoever it might be?

Heath: So in a typical debt recovery dispute, it may be in the tribunal, for instance, that amount of money is awarded to one party or another, or no money is awarded either way and the action is simply dismissed. In a state court, again similar circumstance. But if the party’s actually represented, then they may get a cost order as well on top of that. Which can recover, in part, some of the legal costs incurred. But it will not be all the costs incurred under the proceedings.

Dan: So I suppose the take home message for people that are perhaps wanting to seek some sort of recourse, be it through mediation or litigation, is to get some advice at the outset?

Heath: It’s very important to get advice, that’s right. Very important to get advice, and particularly get an understanding of what this process will involve so you can make a really good informed decision before they start taking steps, rather than blindly running through thinking everything will be fine at the end of it, because it may not be. Because particularly from a solicitor’s perspective, we want to achieve the best result we can for our clients on a commercial basis. There are some instances where that may be a very difficult thing to do, and it may be that they have to do it themselves. But it’s better to, from the client’s perspective, to have that understanding from the start than to find that out halfway through the proceedings. So it’s quite important for people to understand that before they start.

The building and construction space is the source of many legal disputes that arise out of complicated contract arrangements. This will often lead to the parties enforcing their legal rights, which can lead to costly and protracted legal battles. To better understand the issues, and what you can do about them, in this podcast, Commercial Litigation expert, Cameron Marshall of OMB Solicitors discusses the matter.

Podcast: Play in new window | Download

TRANSCRIPT:

Dan: Cameron, is there one intrinsic thing in these matters that tends to be the problem?

Cameron: Yes, I find that it’s probably, it sounds pretty simple but the thing that can be done is for the parties just to read and understand the contract that they’ve signed, that’s probably the first place to start to try and avoid any disputes.

Dan: Is it the case that most people don’t, is that common?

Cameron: I’d say quite a lot unfortunately, it sounds very basic but I see it quite a lot from in my field of work all the time, that disputes could’ve been quite easily avoided by the parties understanding what they had to do, and knowing which way to go when a dispute arises, yeah.

Dan: Is there something about the contract or particular clauses that you think that are typically the drama?

Cameron: Yeah, well, not … Yeah, typically they come from a whole range of problems, because I’ve been doing this job for 20 years odd, so I see a lot of different ones. So when I see things such as something as simple as just the parties, or how they may be named in the contract, they need to make sure that the exact legal entity is named. That comes a real problem if we ever have to enforce payment for work being done if we haven’t even got the contractual parties correct, because it gives wriggle room to a party trying to avoid payment, possibly.

Cameron: Other things like that come up is often when contracts have been negotiated, that’ll take a little bit of time and a start date for the commencement of the work might be included. But, often when the actual contract’s signed, that start date’s passed. So if we’re working on a practical completion date, we’re already halfway through that, we could be halfway through that period and the contractor will be facing some problems down the track, when the completion date’s quickly coming up and he might be getting pressed for completion, etcetera, etcetera. So it’s just those things that need to be sorted out beforehand.

Cameron: The construction schedule’s one that also comes up a lot. It’s one of those things that sometimes gets overlooked in the contractual negotiations, the contractors and the owners and the builders need to just make sure that the construction schedule is one that they can keep, and one that’s realistic. We don’t wanna, again, get into disputes with someone falling behind when the contract, construction schedule itself was just not able to be done.

Cameron: There are even situations where I’ve seen contracts not signed. So-

Dan: Wow.

Cameron: We get a couple of hundred thousand dollars worth of work and the dispute arises and then one contractor says that they haven’t signed the contract. There’s legal ways of getting around that, but you don’t really wanna have to go there if you just check the contract and make sure it’s being signed by the proper party. So there are some of the examples that I see quite often.

Dan: Now, Cameron, when things go wrong, where’s a starting point for people to sort of consider how to resolve this, is it typically the case that they don’t do anything at all, they let these things linger, or what’s the best way around it?

Cameron: Well, again, let’s go back to the contract, let’s see what the contract might say. So let’s talk about a breach of the contract. Normal construction contract if someone’s noncompliant, maybe they haven’t paid a bill, maybe some bit of work is being delayed, then it’s something that can be addressed in the contract by simply providing a notice to the other party. Usually it has to be in writing, but once again, it clears the air and provides certainty as what the other party alleges isn’t done, and it gives time for the other party to do it, and if it’s not done then you can have a look at your legal rights, but again, you go back to the contract, see what it says, and it will guide you through a lot of the problems.

Cameron: There are dispute resolution clauses often in building contracts, now these can be used, I’ve seen one recently where we had a latent defect come up because of soil testing. And it needed to be, there was a dispute between the builder and the contractor, and it needed to be resolved so the parties went through their conciliation process and the arbitration process in the contract which required eventually an independent expert to decide whether it was a latent defect, latent condition sorry, and that resolved that issue so the contract could proceed. It’s not always the case the parties are happy with those rights, but it’s a lot better than going down the legal course if it can be done prior to incurring legal costs, yeah.

Dan: From a practise perspective Cameron, is sort of traits that you see of builders who may sort of sit on these things longer than they should in terms of bringing the issue to a resolution, sort of practical issues that sort of emanate?

Cameron: Well, the building site is, I’ve been on them before in my younger days, it’s a different world there, there’s a lot of trust between the parties and a lot of things spoken orally, which is the normal way to do it and good, but it’s not the good legal way to do it. So, what may be said by one party and understood, thought to be understood between the parties that things may be okay, may not be the situation and when a dispute does arise and the lawyers get involved, then again the contract will be the document that we all look at and will be the one that we’ll be trying to enforce. So, it’s one of those situations where on the building site you don’t wanna rest on your belief and understanding of what the other party thinks is the case, or what you think is the case, rather, let’s get it clarified, let’s go back to the contract, make sure what the parties are doing is understood, and then you can go forward. You don’t want, you thought it was the case, ’cause you’ll just end up in problems down the track.

Dan: So, undeniably, the real take-home message for people listening to this podcast, those that work within, in the industry, is to get advice and make sure these contracts are watertight.

Cameron: Yes, it’s just really … They’re a daunting document when you look at them, but once you’ve had a little bit of experience with them, and you read them, it’s, they’re pretty straightforward and they all have the general similar tone and vein to them, so just understand what you need to do, and if something does go wrong, how do you address it? There are ways to go enforce your legal rights through the courts and the different tribunals, but a lot of that can be avoided simply by knowing what you need to do under the contract and doing that.

Dan: Cameron, thanks for joining me.

The year 2011 will be remembered for natural disasters – Brisbane floods, North Queensland Cyclones, Christchurch earthquake and the Japanese tsunami.

Leading Gold Coast lawyer Simon Bennett says courts are often described as casinos for the rich. “Most people think only large companies and wealthy individuals can afford the cost of litigation and there is some truth in this,” he says. “When civil and business matters can only be resolved by legal action or it is necessary to defend against proceedings there are ways to minimise costs.

“It is essential to remove emotions from the equation. Litigation is often driven by feelings about justice or rights and wrongs. Legal action should only be taken after all the facts and the likely results are established. Few can afford the expense of proving a point in court.

“It is important to choose a specialist solicitor who is experienced and competent. Very few lawyers have experience in running complex litigation in the superior courts. An inexperienced solicitor may make costly tactical errors. Sound representation comes through experience, knowledge of court procedure, and rules of evidence. Poorly drafted court documents are often challenged or redone – this all adds to the cost.

“People who plan legal action should ask their solicitor detailed questions. This will show whether the solicitor has the necessary qualifications and experience. Superior court actions involve a barrister’s fee. The choice of barrister is crucial.

“Errors in the preparation and presentation of a case are costly and may result in a negative outcome. Ensure money is spent wisely by engaging a solicitor who has intimate knowledge of and a good relationship with the bar, and I don’t mean the local pub,” he says.

Simon says the best way of reducing legal costs is to work with a solicitor to establish a reasonable settlement. “Provide the solicitor with as much information as possible as soon as possible,” he says.

“A settlement that is commercially acceptable in the light of risks and costs is a positive result. If a settlement can’t be reached then at least the solicitor has the full picture and the opportunity to gain the tactical advantage,” he says.

This article was featured in Label Magazine, by Simon Bennett